The Rise of Digital Banking in South Africa

- BY MUFARO MHARIWA

- 6 days ago

- 4 min read

Updated: 2 days ago

Since the earliest days of banking, the experience has rarely inspired affection. Long queues, droning background music, and hushed spaces that somehow make time crawl, all for an interaction that often ends without a clear solution. For many, banks have become synonymous with boredom and frustration.

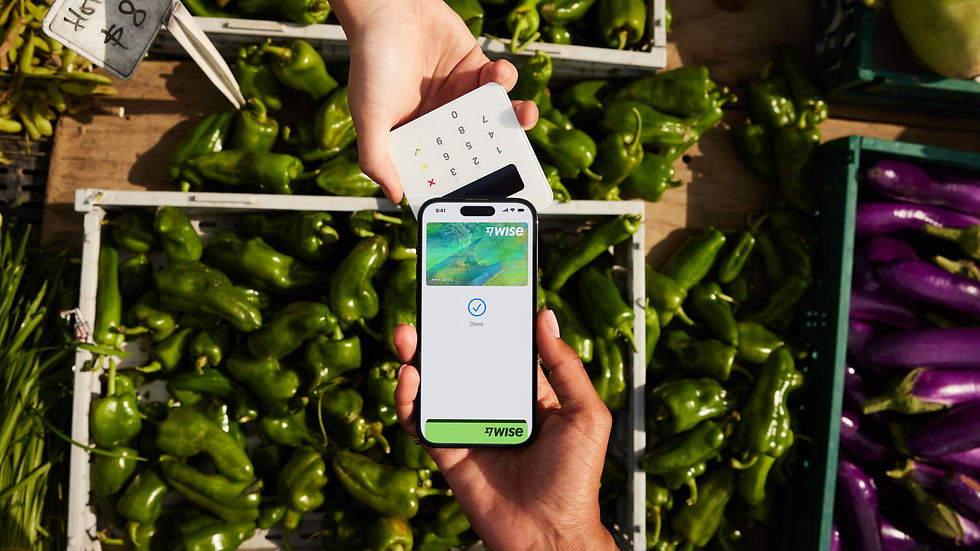

In contrast, the rise of digital banking has quietly rewritten that experience. Today, entire financial lives can be managed from a phone or laptop, without ever needing to step inside a branch, except in rare cases. Payments, transfers, account management, and even lending now happen in a matter of minutes rather than hours.

While both traditional and digital banks have their advantages and limitations, the direction of travel is clear. Digital banking represents the future of financial services, and that shift is becoming increasingly visible in South Africa, where global platforms and local players alike are reshaping how consumers engage with money.

What Exactly Is a Digital Bank?

At its core, a digital bank is exactly what the name suggests: a bank designed to live on your phone or computer rather than on a street corner. Accounts are opened online, transactions are managed through apps, and customer support is handled digitally, often without ever stepping into a physical branch.

Unlike traditional banks, digital banks typically operate with little to no brick-and-mortar presence. That absence is not accidental. By removing physical branches, these banks significantly reduce overhead costs, which often translates into lower fees, faster services, and more competitive exchange rates for customers.

Digital banks tend to prioritise speed and simplicity. Opening an account can take minutes rather than days, transfers are often near-instant, and features such as real-time spending notifications, budgeting tools, and multi-currency wallets are built directly into the platform. For many users, especially younger and tech-savvy customers, this convenience alone is enough to justify the switch.

That said, digital banks are not without limitations. Cash deposits can be inconvenient or unavailable, complex financial products are sometimes limited, and trust remains a hurdle for customers accustomed to decades-old banking institutions. Regulation also plays a critical role, particularly in markets like South Africa, where licensing and compliance are closely monitored.

Still, despite these challenges, digital banks have steadily moved from being niche alternatives to credible competitors. What began as a convenience-driven option has increasingly positioned itself as a viable, and in some cases preferable, way to bank.

Global Digital Banks Set Their Sights on South Africa

South Africa’s banking sector has long been dominated by a handful of traditional institutions, but that landscape is beginning to shift. Global digital banking platforms are increasingly viewing the country as a strategic expansion market, drawn by its sophisticated financial infrastructure, high smartphone penetration, and a population that is already comfortable managing money digitally.

Wise and Revolut are two of the most notable names entering the conversation. Both platforms are often referred to as digital banking players, although their models differ slightly from traditional banks. Wise operates primarily as a global money services platform, best known for low-cost international transfers, multi-currency accounts, and transparent exchange rates. Its recent regulatory approval in South Africa signals a formal step towards deeper local integration, allowing it to serve South African customers more directly.

Revolut, on the other hand, positions itself closer to a full digital bank. Internationally, it offers everyday banking features such as spending accounts, cards, savings products, and investment tools, all housed within a single app. Its announcement of plans to establish banking operations in South Africa reflects growing confidence in the market and an expectation that local consumers are ready for alternatives to traditional banking experiences.

What makes these entrants particularly significant is their global-first mindset. These platforms are built for cross-border living, online commerce, and digital-native lifestyles, areas where traditional banks often lag or charge premium fees. For freelancers, remote workers, travellers, and businesses operating across borders, the appeal is obvious.

Their arrival also signals something broader: South Africa is no longer just a consumer market for fintech innovation but an active participant in the global digital banking ecosystem. As international platforms plant their flags, competition intensifies, and the pressure on local banks to modernise grows.

When Retailers Become Banks

While global fintech players are making their way into South Africa, one of the most disruptive forces in the local banking landscape is coming from a far more familiar place: the supermarket aisle.

Shoprite’s banking offering has grown quietly but rapidly, reaching millions of customers through a model that looks nothing like traditional banking. With thousands of stores nationwide, the retailer has turned everyday shopping locations into access points for basic financial services. Customers can open accounts, deposit and withdraw cash, send money, and manage transactions without ever stepping into a bank branch.

What sets this model apart is accessibility. For many South Africans, especially those in smaller towns or underserved areas, a Shoprite store is far more reachable than a traditional bank branch. Banking becomes an extension of daily life rather than a dedicated errand, removing many of the friction points that have historically made financial services feel intimidating or inconvenient.

The scale is also significant. With millions of active users and a footprint that spans the country, Shoprite’s banking arm demonstrates how trusted retail brands can leverage existing infrastructure to deliver financial services at speed. It is not built around premium features or complex financial products, but around practicality, affordability, and reach.

This retail-led approach challenges long-held assumptions about what a bank needs to look like. There are no marble floors, no hushed queues, and no sense of ceremony. Instead, banking is folded into spaces people already trust and visit regularly, redefining convenience in the process.

More importantly, it shows that the future of banking in South Africa may not belong solely to traditional banks or global fintechs, but to hybrid models that understand local behaviour and meet customers where they already are.

Banking, Rewritten

What is clear is that banking in South Africa is no longer moving in a single direction. Instead, it is expanding outward. Traditional banks are being challenged from both ends, by global digital-first platforms on one side and deeply local, retail-driven models on the other.

For consumers, this growing competition is a net positive. More choice, better pricing, and services designed around real-world behaviour rather than legacy systems. For traditional banks, it is a clear signal that the old model is no longer enough on its own.